Expensive Exchanges: Tips to Avoid Excessive Currency Exchange Fees

Expensive Exchanges: Tips to Avoid Excessive Currency Exchange Fees

When traveling abroad, one of the most overlooked expenses is the cost of exchanging currency. Airports often impose excessive currency exchange fees, making overseas currency exchange much more expensive than using credit cards, local banks or online services in the U.S. Fortunately, there are ways to avoid these high costs and keep more of your hard-earned money for your travels. This article will explore some practical tips for American travelers and highlight experiences that demonstrate the stark differences in exchange fees.

Understanding Currency Exchange Fees

Currency exchange fees can vary widely depending on where and how you choose to exchange your money. Airport kiosks, for instance, are notorious for charging high service fees and offering unfavorable exchange rates. Some credit cards also add foreign transaction fees to your purchases abroad, which can increase costs by up to 3% per transaction. In contrast, local banks in the U.S. and online currency exchange services typically provide better rates and lower fees, making them the preferred options for travelers.

Traveler Anecdotes: The Frustrations and Joys of Currency Exchange

Many travelers have shared their experiences with currency exchange, and the frustrations are evident. John, a first-time traveler, recounted, “I didn’t realize how much extra I was paying until I saw the total fee charged at the airport exchange counter. I could have saved a lot if I had exchanged my money beforehand.” In contrast, seasoned travelers often know to avoid these pitfalls. Sarah, a frequent flyer, explained, “Using an online service like Wise allowed me to lock in a favorable rate and avoid any hidden fees.” The stark contrast in experiences highlights the value of planning ahead.

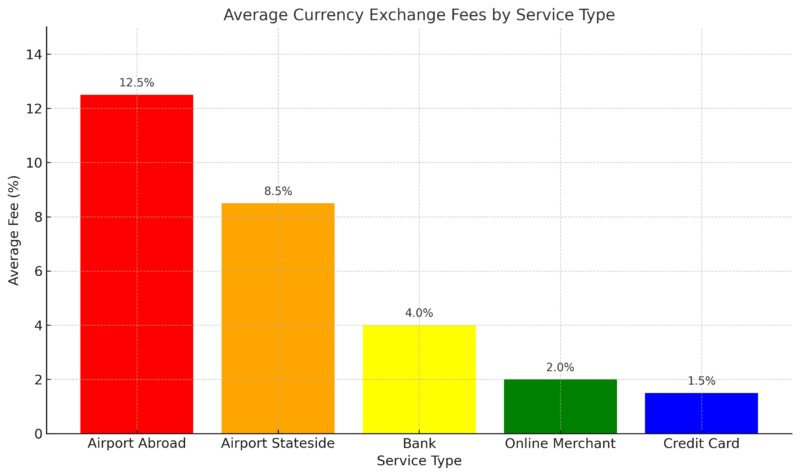

Average Fees: A Comparative Look

To provide a clearer picture of the costs, the following bar chart illustrates average fees paid when exchanging currency at various locations. The chart highlights differences in average fees at airports abroad, airports in the U.S., local banks, online merchants, and credit card transactions. Each category is arranged in descending order from the highest to the lowest average fee, with increments of $5 to make the comparison straightforward:

Source: Wise

Tips to Avoid High Currency Exchange Fees

- Use a Local Bank Before Traveling: Exchange currency at your local bank before leaving the U.S., as banks often offer better rates and lower fees than airport kiosks or overseas options.

- Leverage Online Currency Exchange Services: Services like Wise, Revolut, or OFX provide competitive exchange rates with lower fees compared to traditional banks or airport kiosks.

- Choose Credit Cards with No Foreign Transaction Fees: Use credit cards that offer zero foreign transaction fees, such as the Discover it®, Chase Sapphire Preferred, or American Express® Gold Card, to avoid extra charges on international purchases.

- Avoid Airport Currency Exchange Kiosks: Steer clear of currency exchange services at airports, which typically charge high fees and offer unfavorable exchange rates.

- Withdraw Local Currency from ATMs Abroad: If necessary, use an international ATM network, as withdrawing local currency abroad can still be cheaper than exchanging cash at an airport. Be aware of any ATM fees or withdrawal limits.

- Monitor Exchange Rates in Advance: Keep an eye on exchange rates before your trip and exchange currency when the rates are most favorable.

Conclusion

By being aware of the potential costs and planning accordingly, travelers can avoid the frustration of excessive exchange fees. Whether you are a first-time traveler or a seasoned globetrotter, these tips can help you make smarter decisions about currency exchange. For further research on credit card benefits and rewards, consider visiting resources such as NerdWallet, BankRate, and WalletHub for up-to-date information.